Заполните данные

Заполните данные

A Look at How the Pandemic Affected the Russian VC Market in the First Half of 2020

Дата публикации: 15.10.20

Время прочтения: 5 минут

This year we experienced a new phenomenon, which most people have not experienced in their lifetime, that altered the rules of different markets. The Russian venture capital market is not an exception.

Dsight partnered with Crunchbase to produce a bi-annual report on the state of the VC market in Russia. Crunchbase contributed data related to venture capital deal flow and exit activity in Europe, and globally, in the first half of 2020.

Russian VC Activity: 1H 2020

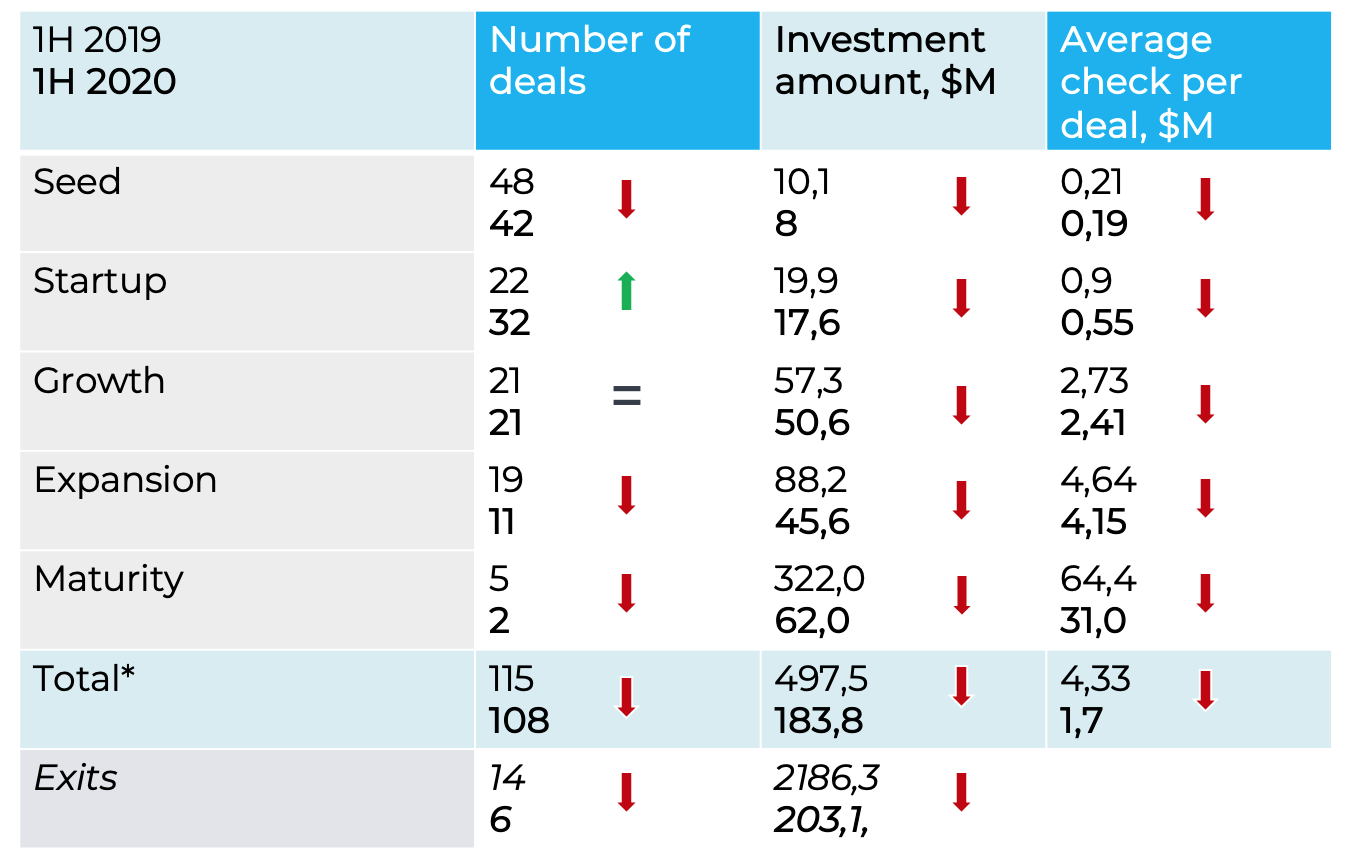

The total value of investments amounted to $184 million, which is three times less than the first half of 2019 (-63.8%). An outflow of money was caused by the stoppage of deals made.

Dsight partnered with Crunchbase to produce a bi-annual report on the state of the VC market in Russia. Crunchbase contributed data related to venture capital deal flow and exit activity in Europe, and globally, in the first half of 2020.

Russian VC Activity: 1H 2020

The total value of investments amounted to $184 million, which is three times less than the first half of 2019 (-63.8%). An outflow of money was caused by the stoppage of deals made.

The Russian VC market experienced a significant drop in late-stage volume. Expansion-stage deals experienced a 48% decrease, while maturity saw an 80% decrease.

How Investors Reacted to the Pandemic

The first half of 2020 experienced a total of 108 investment deals in startups. Due to the ongoing pandemic, investors decided to take the safe route and withhold from making large investments. The number of investments in almost all stages experienced a significant drop with the total decrease of 6% in comparison to last year.

However, the key figure here is not the amount of investments but the value and average check of them. The average check decreased from $4.33 million to $1.7 million (-60%), and the total volume fell by 63%, from $497.5 million to $183.8 million. Investors didn’t stop funding the market, they just decreased the size of their investments.

Startups in their late stages (expansion and maturity phases) saw the largest drop in volume, -48% for expansion phase and -80% in maturity phase.

Surprisingly, the most active investors were business angels, who were the only ones who had an increase in their total deals. On the other hand, corporations and corporate funds saw the largest drop in average check, a whopping 80% decrease, which can be attributed to the pandemic affecting the corporate sector much heavier than others. Analytics also want to highlight the active investing activities of the government sector in the first half of 2020–the volume of government investments will most likely grow in the future.

New Focus for Entrepreneurs and Investors

A new goal emerged for entrepreneurs and government officials – to continue its activities and its interaction with care for the health of the population during the ongoing COVID-19 pandemic. Limitations in work acted as a barrier, and those who were able to received new points of development in their business. Today we see a large amount of innovative solutions in areas such as online education, telemedicine and robotics services, which saw growth in interest. Out of $108 million invested in the leading industries, investors allocated their money in transportation services (14 deals) and education (12 deals).

We hope that the tempo of the market will stabilize in the 2nd half, which can already be seen by certain indicators in July and August.

The pandemic is the black swan of the 21st century. We witness sharp changes from growth to decline, which leads to the formation of new rules within the VC market.

How Investors Reacted to the Pandemic

The first half of 2020 experienced a total of 108 investment deals in startups. Due to the ongoing pandemic, investors decided to take the safe route and withhold from making large investments. The number of investments in almost all stages experienced a significant drop with the total decrease of 6% in comparison to last year.

However, the key figure here is not the amount of investments but the value and average check of them. The average check decreased from $4.33 million to $1.7 million (-60%), and the total volume fell by 63%, from $497.5 million to $183.8 million. Investors didn’t stop funding the market, they just decreased the size of their investments.

Startups in their late stages (expansion and maturity phases) saw the largest drop in volume, -48% for expansion phase and -80% in maturity phase.

Surprisingly, the most active investors were business angels, who were the only ones who had an increase in their total deals. On the other hand, corporations and corporate funds saw the largest drop in average check, a whopping 80% decrease, which can be attributed to the pandemic affecting the corporate sector much heavier than others. Analytics also want to highlight the active investing activities of the government sector in the first half of 2020–the volume of government investments will most likely grow in the future.

New Focus for Entrepreneurs and Investors

A new goal emerged for entrepreneurs and government officials – to continue its activities and its interaction with care for the health of the population during the ongoing COVID-19 pandemic. Limitations in work acted as a barrier, and those who were able to received new points of development in their business. Today we see a large amount of innovative solutions in areas such as online education, telemedicine and robotics services, which saw growth in interest. Out of $108 million invested in the leading industries, investors allocated their money in transportation services (14 deals) and education (12 deals).

We hope that the tempo of the market will stabilize in the 2nd half, which can already be seen by certain indicators in July and August.

The pandemic is the black swan of the 21st century. We witness sharp changes from growth to decline, which leads to the formation of new rules within the VC market.